Certain countries and states require you to collect taxes on your sales. WHMCS allows you to specify the tax rates on a regional basis. Let’s see how. Watch the video of this on Specify Tax Rules with WHMCS

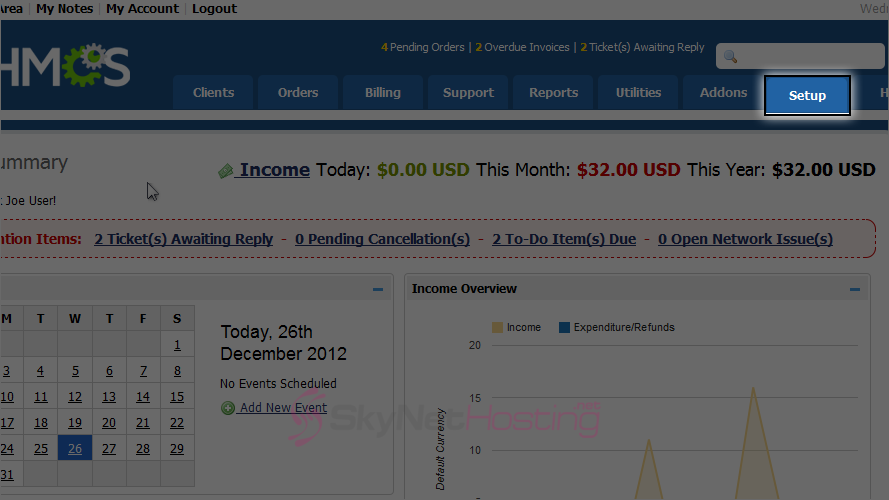

- Log into WHMCS admin panel and select the Setup tab.

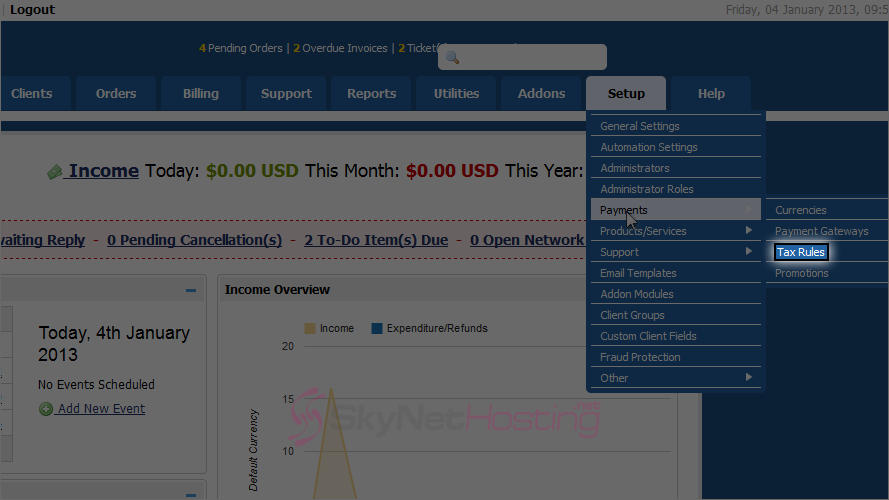

- Hover over Payments to open the sub menu.

- Select Tax Rules.

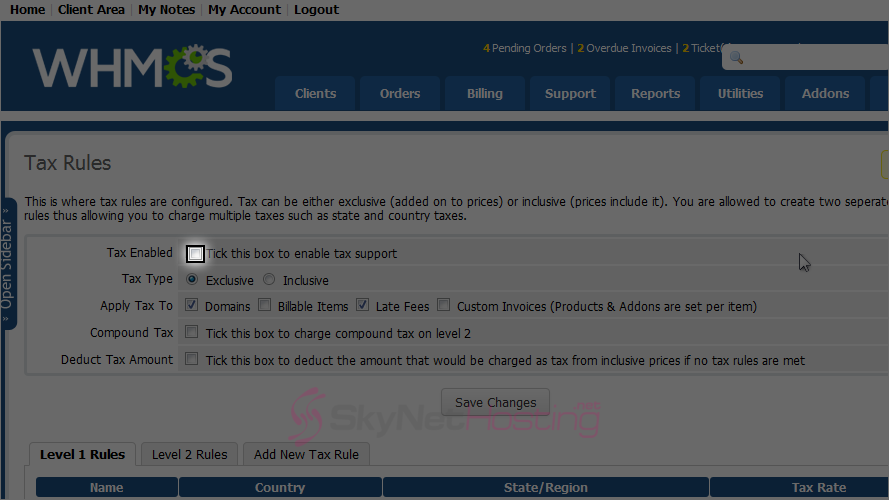

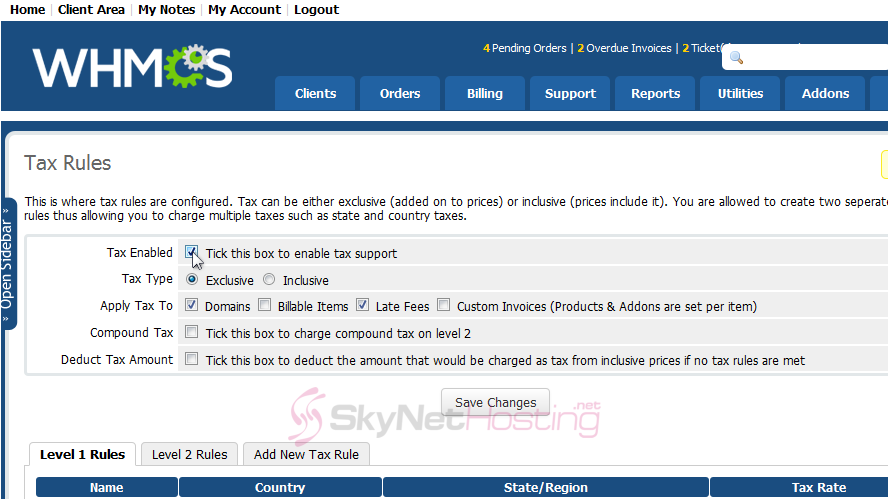

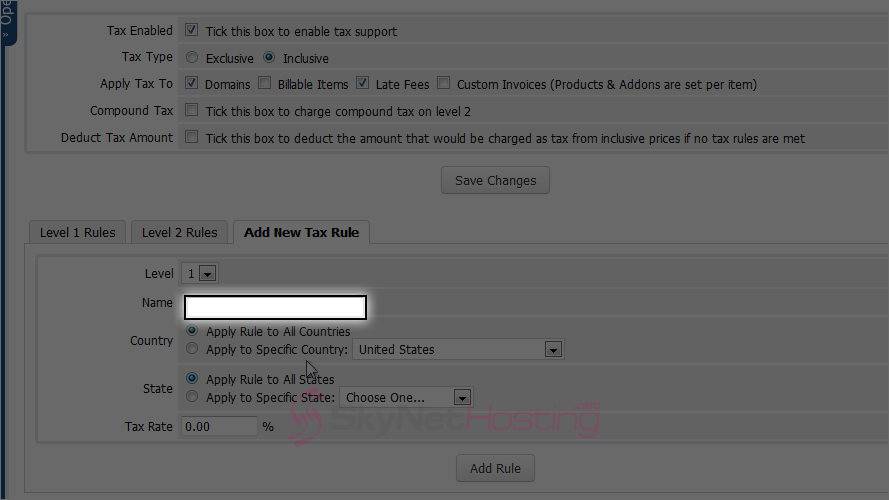

- By default, taxes are not enabled. Check this box to enable them.

- Select whether you want your prices to include the taxes (inclusive) or have them added on top of your prices (exclusive).

- Using these fields, specify whether taxes should be applied to domains, custom invoices or late fees.

- Enabling Compound tax will apply the level 2 tax rates to the total after level 1 taxes have been applied instead of to the subtotal.

- When finished, click Save Changes.

- Scroll down to set tax rule to level one. Click Add New Tax Rule.

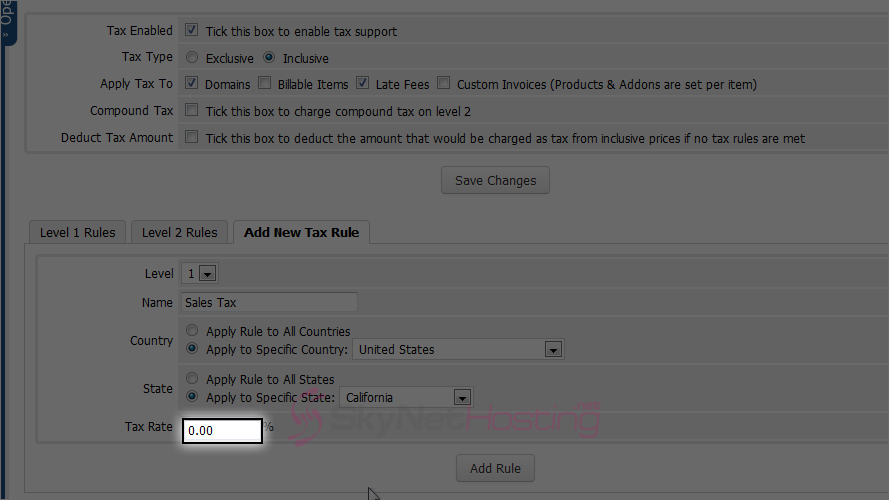

- Give the tax a Name.

- Choose whether the rule should apply to all countries or a specific country.

- Do the same thing for state.

- Last, set a Tax Rate.

- To finish, click Add Rule. You can add as many tax rules to either level as you want.

That’s it! You now know how to specify tax rules with WHMCS.